News

Proposed 2025 Changes to Social Security

In recent years, there has been ongoing discussion and debate about potential changes to the Social Security system in the United States. This year is the same as the Social Security Administration, which is considering numerous changes for 2025.

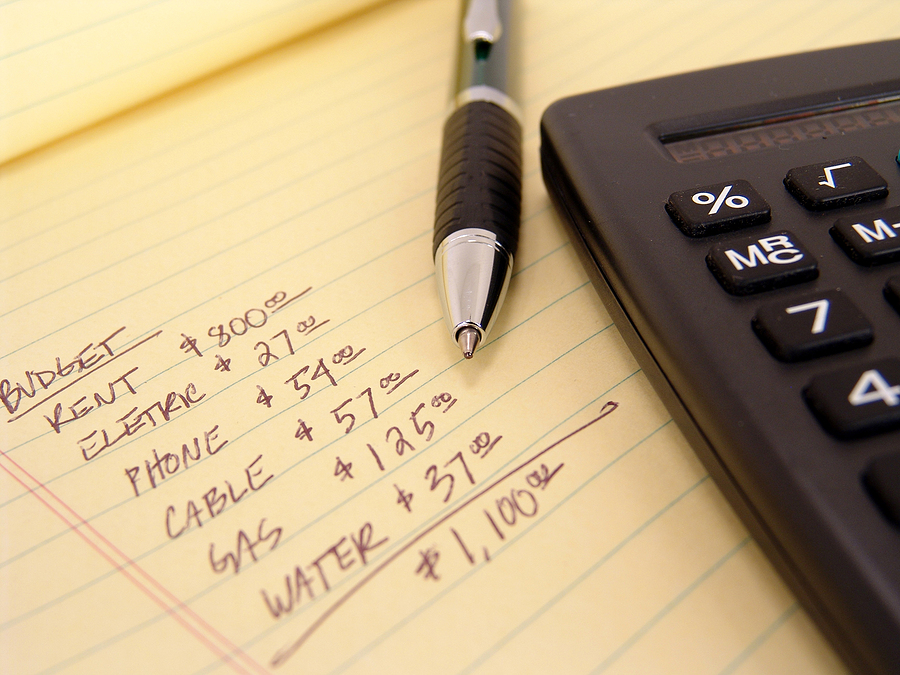

7 Ways to Celebrate Financial Planning Month

October is recognized as Financial Planning Month, an annual event dedicated to planning for an independent financial future. Whether you’re a novice or knowledgeable in finance, assessing your finances and goals is always beneficial.

5 Tips for Financial Independence in Retirement

Many people are concerned about financial independence as they approach retirement. Whether you’re a decade away from retirement or it’s near, there is no better time to implement these five tips than now.

How Does The SSA Calculate Your Retirement Benefits?

The Social Security Administration (SSA) is a vital agency in the United States that provides financial support to eligible retirees through Social Security Retirement benefits. This critical aspect of retirement planning is often misunderstood, leading to confusion about benefits calculation. This article explores the main components to how the SSA calculates retirement benefits.

Common Fears About Social Security and How to Mitigate Them

One of the most significant fears many aging Americans face is that Social Security retirement benefits will disappear. With continuous news about potential solvency issues, sustainability concerns, and funding concerns, it’s no surprise that apprehensions are often heightened. This article aims to reduce these anxieties by discussing common questions related to fears about Social Security.

5 401(k) Facts You May Not Know

A 401(k) is a retirement savings plan sponsored by an employer that allows workers to save and invest a portion of their paycheck before taxes are taken out. While many individuals may be familiar with the basics of this popular retirement savings vehicle, some lesser-known features and details could significantly impact your long-term savings strategy. Here are some 401(k) facts

A Recap: Significant 2024 Retirement Savings Changes

The landscape of retirement savings in the United States is experiencing crucial changes following newly enacted legislative changes for 2024. These updates and reforms seek to enhance the flexibility of retirement savings accounts. They also seek to transform how Americans save and prepare for retirement. Here are some of the more significant changes this year.

Politics, Elections, and Your Retirement Savings

To truly grasp how politics and elections may impact retirement savings, it’s necessary to consider multiple dimensions. Elections, policy changes, geopolitical events, and even political rhetoric can influence economic activities, indirectly affecting the financial markets. Therefore, understanding the correlation between these domains is critical. And necessary in making informed decisions regarding elections and your retirement savings. Here are the areas

5 Tips to Save Money During Back-to-School Season

The back-to-school season can be an expensive affair for families. Purchasing new backpacks, school supplies, clothes, and other necessities can significantly dent the family budget. However, you can effectively navigate this potentially costly period by implementing strategic planning and a few money-saving tactics while covering all your children’s needs. Here are five tips to save money during the back-to-school season.

7 Smart Strategies to Pay Off Your Mortgage Ahead of Schedule

You as a homeowner may strive to pay off your mortgage ahead of schedule. This goal gives them the confidence that comes with owning their home outright and can save them significant money in interest payments over the long term. Here are seven smart strategies to work toward this goal.